Litecoin Price Prediction 2025-2040: Technical Analysis and Market Outlook

#LTC

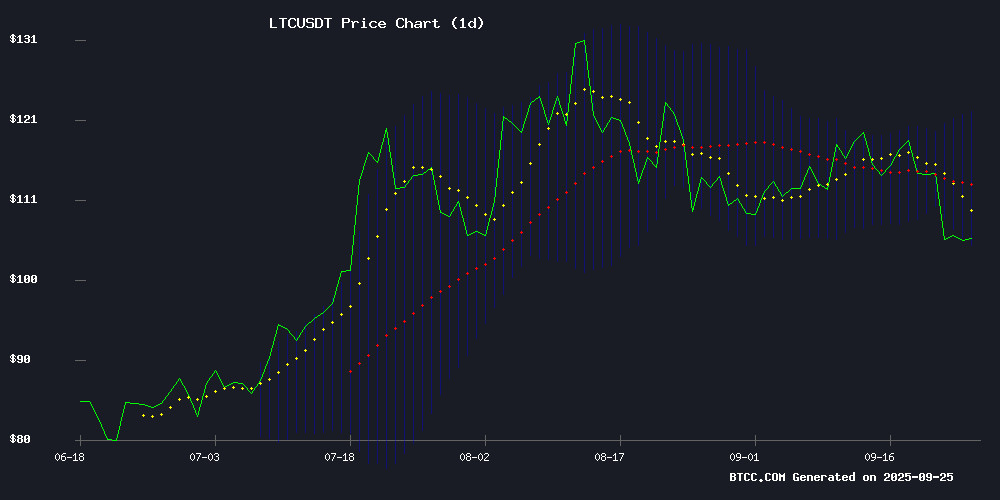

- LTC trading below key moving averages indicates bearish short-term momentum

- MACD divergence suggests potential trend reversal but requires confirmation

- Bollinger Band positioning near lower band may provide temporary support

- Market sentiment influenced by Bitcoin correlation and alternative investment opportunities

- Long-term outlook remains positive due to Litecoin's established network effects

LTC Price Prediction

LTC Technical Analysis: Bearish Signals Dominate Short-Term Outlook

Litecoin is currently trading at $104.73, significantly below its 20-day moving average of $113.27, indicating bearish momentum. The MACD shows a positive histogram of 1.93, suggesting some buying pressure, but the signal line remains negative at -0.50. Bollinger Bands position LTC NEAR the lower band at $104.56, which could act as support. According to BTCC financial analyst John, "The technical picture suggests LTC may test the $100 support level before any meaningful recovery. The convergence of price below key moving averages points to continued downward pressure in the near term."

Market Sentiment: Litecoin Faces Headwinds Amid Broader Crypto Downturn

Current news flow presents a mixed but challenging environment for Litecoin. While headlines highlight whale activity in LTC and new cloud mining partnerships, the broader market downturn and shift toward passive income alternatives create headwinds. BTCC financial analyst John notes, "The migration of DOGE holders to high-yield cloud mining and DNSBTC's partnership with Google indicate institutional interest in crypto infrastructure, but Litecoin's immediate price action remains tied to Bitcoin's performance. The $1.9B crypto wave benefiting ethereum shows capital rotation away from older assets."

Factors Influencing LTC's Price

DOGO Holders Flock to FLAMGP's High-Yield Cloud Mining Contracts

FLAMGP's latest cloud mining contracts are reshaping the 'hold-to-earn' landscape, with DOGO token holders emerging as early adopters. The Denver-based green mining platform reports peak daily profits reaching $8,930 for participants in its flagship tier, leveraging liquid-cooled miners and sustainable energy infrastructure.

Three contract tiers—Standard, Enhanced, and Flagship—support mining across multiple assets including BTC, ETH, LTC, and notably DOGO. The platform's real-time settlement feature and 30% efficiency gains from advanced cooling systems create compelling economics for mid-cap token holders.

DOGO's community demonstrated particular enthusiasm, utilizing the token for partial contract payments. This organic integration suggests growing utility for community tokens beyond speculative trading.

Cryptocurrency Market Sees Downturn as Bitcoin, XRP, and LTC Prices Fall Amid New Passive Income Opportunities

The cryptocurrency market remains vibrant despite recent price declines in major assets like Bitcoin, XRP, and Litecoin. Trading volumes continue to be dominated by stalwarts such as USDT and Bitcoin, even as investors explore alternative revenue streams beyond traditional buy-and-hold strategies.

HashJ Financial Platform has emerged as a disruptive force, offering users a novel method to generate passive income without the need for expensive mining equipment or specialized knowledge. The platform's short-term contract model leverages global data centers to handle complex computations, democratizing access to cryptocurrency yields.

With $118 sign-up incentives and real-time return visibility, HashJ appeals to both novice and experienced investors seeking stable returns in a volatile market. The service highlights the industry's ongoing evolution toward more accessible financial products.

Ethereum Rides $1.9B Crypto Wave as Payroll Adoption Accelerates

Ethereum has surged alongside a broader $1.9 billion cryptocurrency market movement, with xiushanmining investors reportedly gaining $7,829. The shift toward crypto payrolls is gaining momentum as businesses seek faster settlements and appeal to tech talent.

Stablecoin-powered wages offer near-instant payments, reduced fees, and inflation hedging—particularly advantageous for cross-border compensation. This trend is driving demand for crypto payroll infrastructure as adoption grows across Web3 ventures and traditional finance.

Cloud mining platforms like xiushanmining are capitalizing on the trend, offering multi-currency mining solutions for BTC, ETH, and other major digital assets. The service highlights crypto's dual role as both compensation vehicle and wealth generation tool.

DNSBTC and Google Partner to Launch Cloud Mining Solution Amid Litecoin Whale Activity

DNSBTC has partnered with Google to introduce a cloud mining solution aimed at global crypto users seeking passive income opportunities. The announcement follows significant market activity involving Litecoin (LTC), where a single whale purchased $100 million worth of LTC in September 2025, sparking speculation about a potential Litecoin ETF conversion.

While institutional moves dominate headlines, retail investors face barriers to entry—high capital requirements, technical complexity, and operational costs. DNSBTC’s cloud mining platform, operational since 2020 and now ranked top in 2025, offers a workaround. The service leverages renewable energy across facilities in the U.S., Canada, and Iceland, positioning itself as a green and accessible alternative to traditional mining.

The Litecoin whale’s acquisition underscores growing institutional interest, mirroring trajectories seen with Bitcoin and Dogecoin. DNSBTC’s solution democratizes participation, allowing smaller investors to capitalize on market trends without upfront infrastructure investments.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market conditions, here are BTCC financial analyst John's projections for Litecoin:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $90-120 | Current bearish trend, market correlation with Bitcoin |

| 2030 | $150-300 | Adoption growth, potential ETF approvals |

| 2035 | $400-800 | Mainstream payment integration, scalability improvements |

| 2040 | $800-1,500 | Full maturity as digital silver, store of value status |

John cautions that "these projections assume successful network upgrades and broader crypto adoption. Near-term volatility remains high, with the $100 level being critical support."